Real Estate

The topic of real estate can be confusing because there are so many sectors and conflicting opinions. This is a topic we’ve given much thought to here at Leaders Real Estate. In this article, we will compare residential real estate to commercial estate.

Residential Real Estate

The value of residential real estate is largely determined by the location, whereas commercial real estate is valued largely by the cashflow. Residential requires less capital than commercial real estate and therefore is a great place to get started. Typically, 10% of the purchase price is required as a down payment and the rest can be borrowed.

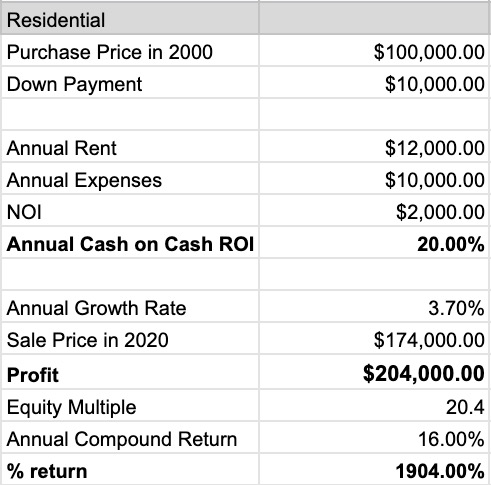

If you are purchasing a rental property for $100,000 that requires $10,000 as a down payment, the remaining $90,000 can be borrowed as a mortgage. There will also be closing costs, so keep in mind that these are round numbers for hypothetical examples.

Assume the annual rent is $12,000 and the annual expenses, including the mortgage payment and capital expenditures, are $10,000. This leaves a net operating income of $2,000, which equates to a cash on cash ROI of 20%. The principal amount owed is also getting paid down, so the real rate of return will be higher.

Historically, real estate has increased in value at a rate of 3.7%. This doesn’t like much,but remember that the purchase was made using leverage. Since only 10% of the purchase price was required upfront, this leads to a 37% return on the capital outlay.

Assume a $100,000 house was purchased in 2000 and grew in value at an annual rate of 3.7% while generating a net operating income of $2,000 a year. The value of the house would be $174,000 and the total profit from rent would be $40,000. This means the $10,000 down payment yielded a return of $204,000. That equates to a 16.5% annual compounding return and a total return of 1,904%.

Note: At the time of sale, there may be a small debt balance remaining for the property which is not considered in these examples.

These numbers are staggering, however, there is a huge caveat. This is not to be mistaken with passive income. Residential rentals require time and attention, so this is better categorized mini-business. The amount of money that your time and attention is worth will have to be determined by you. $2,000 a year may not be a great return on investment if it requires several hours a month of your time.

Another drawback to residential real estate is that it does not scale proportionally. Specifically, rent doesn’t increase at the same rate as the purchase price. A house that sells for $100,000 might easily rent for $1,000 a month, but a house that sells for $1 million will probably not rent for $10,000 a month. So, although the rate of return looks great on paper, the actual amount of money earned is bottlenecked by the amount of deals completed.

We think residential real estate is a great first step as an investor. Whether your 18 or 58, buying a property to rent or flip will show you what to look for when investing money with others as well as give you an appreciation for the work that goes into running a real estate business. Step two is usually getting involved in a small multi-family project such as a duplex, triplex, or quadplex. Lastly, most real estate investors end up gravitating toward commercial real estate as the final step.

Commercial Real Estate

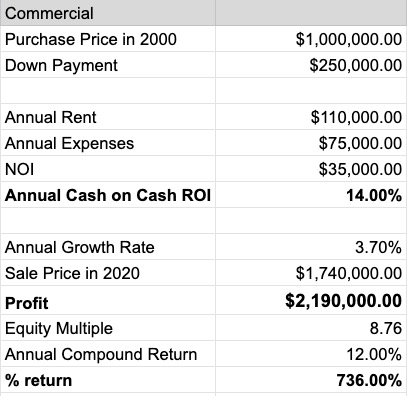

Commercial real estate is different than residential because the value of the asset is driven by the cashflow where as in residential real estate the value is driven by the location. Commercial real estate also requires a higher down payment because most banks will only lend 70-80% of the value of the building. This means the cash on cash ROI will be lower. However, commercial real estate has near infinite scalability.

Let us say a commercial building is purchased in 2000 for $1,000,000 that requires a $250,000 down payment, has an annual rent collection of $110,000, and $75,000 of annual expenses. The net operating income, NOI, is $35,000. This equates to a cash on cash ROI of 14%. Assuming the same annual growth rate of 3.7%, the building would be worth $1,740,000 in 2020. Adding together the net income plus the appreciation of the asset creates $2,190,000 in profit for the investor. This equates to a 12% annual compound return and a total return of 736%.

The ROI of commercial real estate is lower in this example because the down payment is higher, but this ROI holds true as the value of the building increases. So, on a $10 million commercial asset, the investor can still expect similar returns. In order to get the same return on $10 million in residential real estate, the investor would have to purchase 100 houses.

Another factor in deciding which route to go is the quality of the tenants and the lengths of the leases. In residential, 12-24 months is considered a long lease and the landlord is responsible for all maintenance and repairs. In commercial, a good broker will have tenants sign leases for five to ten year terms. Additionally, commercial tenants are usually responsible for maintenance up to a certain amount. This means that commercial real estate is much closer to passive income than residential.

Although both options are have benefits, commercial real estate investments require less time and attention while providing scalability which is what makes it the final destination for so many investors. The goal if this article is not to push one investment over another, but rather to help to simplify a complex subject by providing data and perspective.

If you’d like to see our comparison of real estate, cash, and stocks, check out our article on the three options for your money.

If you need help finding a location or you’re ready to invest in commercial real estate, email us at podcast@leadersre.com.

*We are not financial advisors and do not endorse any particular investment. All references above are hypothetical and we are not responsible for any gains or losses incurred by following these recommendations.*