3 Pieces of Money You Need To Know About

Earnest Money

Earnest money is a check written at time of offer that proves to a seller you’re serious about the purchase. Earnest money is held in escrow until closing and then applied towards the purchase. Earnest money usually ranges from $500 to $5,000 depending on the price of the home.

Appraisal Money

If a mortgage is involved, your lender must order an appraisal to ensure the house is worth the amount it’s lending. This typically costs between $450–$500 and is paid directly to your lender within the first five days of the contract period.

Inspection Money

If you choose to do a home inspection, it’s you’re right to choose any inspector you deem qualified, even if that’s your Uncle Billy Bob. If you don’t already have an inspector in mind, Jason will recommended and even schedule on your behalf a group of highly skilled, experienced, and licensed inspectors that put your best interest first. Inspections typically occur in the first 7-10 days after having a fully executed contract and can range from $250-$1,000depending on the home’s features (pool, septic, chimney, etc) and depending on how in depth you want to go.

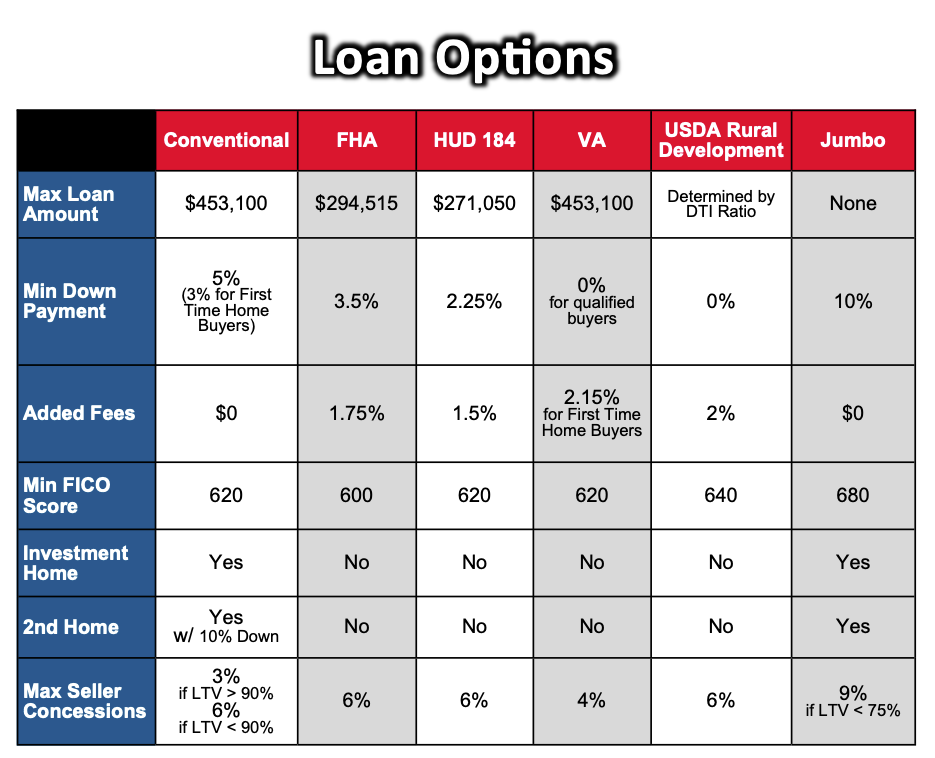

LTV = Loan to Value Ratio

HUD 184 eligible borrowers must be American Indians or Alaska Natives who are card members of a federally recognized tribe.

USDA Rural Development requires the property address be located in certain rural areas.

Currently all of Catoosa, Collinsville, Coweta, Owasso, Skiatook, & Sperry qualify. Bixby, Broken Arrow, Sand Springs, Sapulpa, and most of Claremore do not.

FHA, HUD 184, VA, & USDA Rural Development all have property condition requirements which are mini- mum standards for health and safety. The home must be habitable and comfortable, without any potential hazards to the home buyer. Common requirements include a roof in good state of repair, a structurally sound foundation, finished flooring in average condition or better, no missing built-in appliances, no peeling or chipping paint, handrails on all steps and stairways.

Credit Do’s and Dont’s

5 Factors That Decide Your Credit Score

- Payment history. Do you pay debts on time?

- Amount of debt. Less is best.

- Credit history. The longer the better.

- Amount of new credit. New credit is considered more risky!

- Types of credit, i.e. installment loans, credit cards, and a mortgage.

Credit scores range between 200 and 800. Scores above 640 are considered desirable for obtaining a mortgage. For more on evaluating and understanding your credit score,

go to www.myfico.com.

Credit Do’s

- Pay your mortgage or rent payments on time.

- Stay current on all outstanding accounts.

- Continue working for the same employer.

- Stay with your current insurance company.

- Notify your Lender immediately if any situation arises that could possibly affect your income, assets, or credit.

Credit Don’ts

- Don’t switch bank accounts.

- Don’t transfer balances between accounts.

- Don’t increase the balance of any credit cards.

- Don’t consolidate debt, including credit card debt.

- Don’t close any accounts, including credit card accounts.

- Don’t apply for ANY credit (new vehicle, furniture, appliances, etc).

- Don’t change your job, employer, the way you are paid, or become self-employed.

- Don’t pay off charge-off or collection accounts before consulting with your lender.

- Don’t make large deposits without the ability to document the source of the funds.

What Are Closing Costs?

Closing costs are fees associated at the closing of a real estate transaction when the ti- tle of the property is transferred from the seller to the buyer. Closing costs typically range from 2-5% of the purchase price and are incurred by both parties. Here are some common closing costs:

- A fee for running your credit report.

- A loan origination fee, which lenders charge for processing the loan paperworkfor you.

- Attorney’s fees.

- Discount points, which are fees you pay in exchange for a lower interest rate.

- Survey fee, which covers the cost of verifying property lines.

- Title search fees, which pay for a background check on the title to make surethere aren’t things such as unpaid mortgages or liens on the property.

- Title insurance, which protects the buyer and lender in case the title isn’t clean.

- Escrow deposit, which pays a couple months’ property taxes, homeowner’sinsurance, and private mortgage insurance (PMI).

- Prorations for your share of homeowner’s association fees.

- Recording fee, which is paid to the county in exchange for recording the new land records.

Lenders are required by law to give you a Loan Estimate, which will include what the closing costs on your home should be. At least three business days before closing, the lender will give you a Closing

Disclosure statement, which outlines exact closing fees. This Closing Disclosure statement must be signed by the buyer the same day it is issued to avoid a delay in closing.

Home Warranties

What is A Home Warranty?

A service contract that covers the repair or replacement of important home system

components and appliances that break down over time. That means whether it’s your A/C unit burning up in summer, your heater failing in winter or any number of other covered

systems and appliances calling it quits, you and your family will have one less thing to worry about.

Why is a Warranty Recommended?

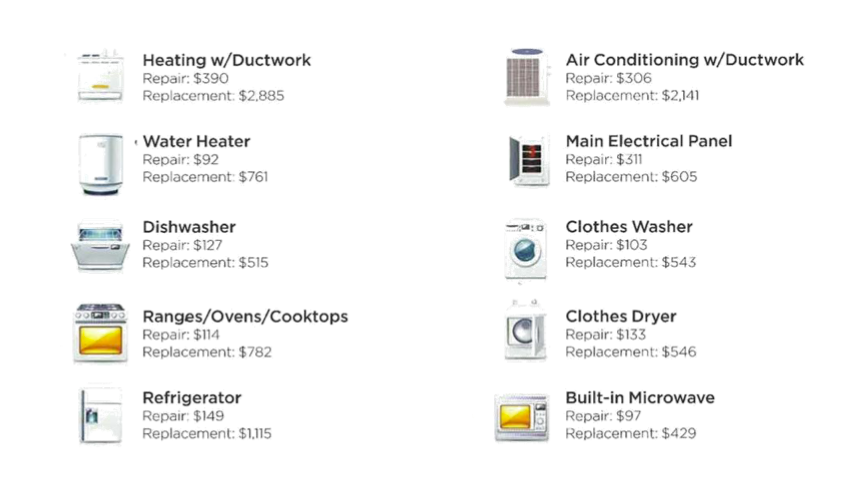

Breakdowns are inevitable – home system components and appliances simply wear out over time. Unlike most homeowners insurance, a home warranty plan protects your budget by covering an un- expected repair or replacement of crucial items when they stop working due to normal wear and tear, saving you money in the long run. Think of it like this…

Homeowners Insurance Covers Things That MIGHT Happen.

Fire Damage, Hail & Wind Damage, Theft & Vandalism

A Home Warranty Covers Things That WILL Happen.

Breakdowns of HVAC Systems, Water Heater, Oven, Dishwasher, Plumbing & more

Without a home warranty…

Repair or replacement of key home systems and appliances can be expensive. Here’s a sample of some of the most common systems and appliances and their average repair and replacement costs.

Inspections 101

General Overview

Inspections should take place in the first 7-10 days after the contract has been fully executed. If you don’t have preferred inspectors, James can not only recommended, but schedule highly skilled,

experienced, and licensed inspectors that put your best interest first and can schedule them for the same day to save you time and money. Most inspections cost between $250-$1000 depending on how in depth you want to go.

EMP (Electrical, Mechanical, Plumbing)

The EMP is a basic home inspection which evaluates many components of the home including but not limited to all light switches, electrical outlets and main breaker, the water meter, water heater, duct system, ceiling fans, fireplace, oven and cook top, dishwasher, built-in microwave, trash

compactor, all sink faucets, toilets, tubs and showers, the furnace, and the air conditioning system when weather permits. Windows, doors, and floor coverings (tile, carpet, etc.) are NOT included.

Roof

The inspection covers the main roof covering material only and will give buyers an estimate of how much life remains. Unless it is raining at time of inspection or there has been a recent heavy rain, it may not be possi- ble to detect a roof leak.

Structural

A structural engineer can identify any visible distress indicating foundation settlement, i.e.

structurally significant cracks in the slab, sheetrock cracks, veneer cracks, visible structural frame deficiencies, etc. and make recommendations for repair. It’s important to note that a general home inspector cannot evaluate and make the same recommendations as a structural engineer.

Drainage

An engineer will evaluate the slope and grading of a yard to check that water freely exits the property to assure unrestricted, healthy, and environmentally safe use of land are-

as.

Termite & Wood Rot

An exterminating company will inspect your home and yard for troublesome ro- dents, insects, spiders and termites while also checking your property for any rotted wood or moisture damage.

Additional Inspections

Other popular inspections include the testing of the chimney, sprinkler

system, septic system, pool and spa, as well as evaluating the crawl space (if applicable). Be sure to inform James if you want any of these additional inspections performed since they are an additional cost and may even require different inspectors to be scheduled. It is also important to note that the inspection only covers the main dwelling, therefore shops, detached garages, pool houses, and other structures are not included

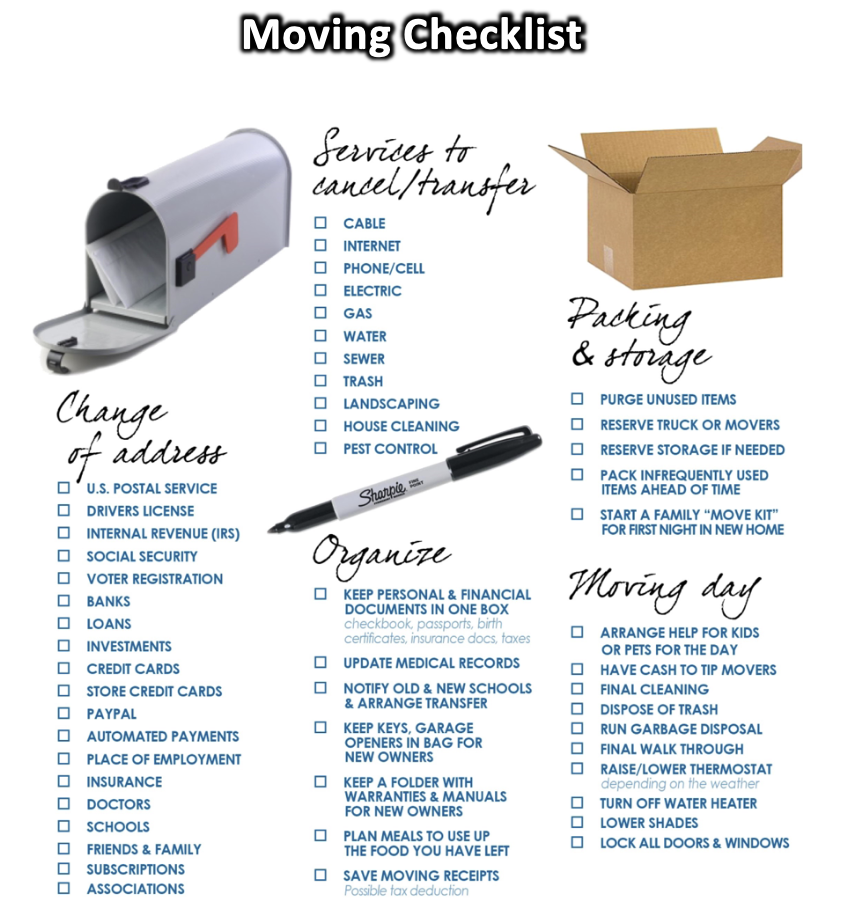

12 Moving Tips

If possible, move on a weekday while banks, utility companies, and government offices are open.

Use sheets, blankets, and towels to separate pictures, dishes, and other fragile objects. This cuts down on space and moving supplies. Socks can be slipped around the wine glasses to help pad the delicate stems.

Instead of wrapping each plate in newspaper or costly bubble wrap, alternate the real plates with Styrofoam disposable plates and — voila! — Instant padding. Genius, right?

Pack plates vertically, rather than flat and stacked.

Mark each box with its contents and destination room so that you and

your helpers will know where each box belongs at your new pad.

Fill two “OPEN ME FIRST” boxes containing snacks, instant coffee, tea bags, soap, toilet paper, toothpaste and brushes, medicine and toiletry items, a flashlight, tool kit, paper plates, cups, utensils, paper towels, and any other items you can not live without.

Have suitcases on wheels? Use them for packing heavy things like books.

Break out the garbage bags and pull one bag up around a cluster of your hanging clothes, then tie the open end by the hangers.

Take pictures of which TV cable goes to which input on the

different components, or how certain knick-knacks are displayed on the bookshelves to serve as an unpacking guide. Photos may also

protect your goods for insurance purposes should anything get damaged in the move.

In the new home, resist the temptation to pile boxes into the garage, attic, or back closet, with a prom- ise to get to them later. If a boxful of stuff is so unnecessary that a year could pass without needing the con- tents, maybe it’s time to ditch the contents before the move. Otherwise, you risk

forgetting where you put important things, or end up parking the car outside all winter.

The desire to relax is strong. The coffee table pushed up against the sofa looks so inviting, but those boxes aren’t going to unpack themselves. Resist the urge to derail your momentum.

Otherwise, those boxes will just stand over your head. Unpack the TV last, sink deeply into that comfy couch, and revel in the knowledge of a well-done moving job any pro would envy.

If moving locally, arrange for your pets to stay with a friend or family member as animals can become confused and frightened during a move.