Three Options for Your Money

There are three common places to put your money; cash, stocks, and real estate. You can also invest your money into a private business, but for this article we will focus on the three options mentioned above.

These categories can be broken down even further. Stocks have options, shorts, and longs. Real estate can be categorized into residential, commercial, and Real Estate investment trusts (REITS).

Cash

Cash is the default place to store your money, either in bank accounts or in actual bills. The reason it’s the default is because it’s the most convenient. Money is deposited into your bank account from you source of income and you don’t need to do anything else.

Cash is also the most expensive place to keep your money because of the invisible tax called inflation. At Leaders Real Estate, we recommend saving six to twelve months worth of living expenses in cash for worst case scenarios, but anything over that will cost you.

The interest rate most banks pay for holding your cash is around .06%. If you saved $100,000 and kept it in the bank, they would pay you $60 a year, which is almost nothing in comparison to the principal amount. If you invested $100,000 in the bank in the year 2000 it would be worth $101,206 by 2020 with a net gain of $1,206.

On average, the annual rate of inflation is between 2 and 3%. Hypothetically, this means if a gallon of milk costs $1 today, it would cost about $1.03 in one year. It’s also why some companies give an annual 3% raise to employees.

In the year 2000, $100,000 had the purchasing power of $148,000 in today’s dollars. That equates to 48% inflation in the last 20 years. In the year 1975, $100,00 had the purchasing power $476,000 which equates to 376% inflation.

In our opinion, this makes cash the worst option for your money because every year you will lose 2-3% of the value.

Real Estate

There are three types of real estate that we will cover:

- Residential real estate

- Commercial real estate

- Real Estate Investment Trusts (REITS)

Real Estate Investment Trusts REITS

A REIT is an organization that invests in a diverse range of income producing real estate assets. The properties vary in class and geography, lowering the risk by increasing the diversification. Asset classes include multifamily, retail, industrial, self storage, warehouses, data centers, medical, infrastructure and hotels. Most REITs are publicly traded, meaning anyone can invest with them through the major stock exchanges.

A unique benefit of a REIT is that it combines the stability of real estate with the liquidity of the stock market. It provides investors with a chance to own valuable real estate they would not be able to acquire otherwise. REITS also provide handsome dividend based income.

The REIT shareholders earn a share of the income of the real estate assets without having to personally acquire and manage the property. It is a truly passive investment. Individuals can also invest through their 401k’s.

A REIT operates by acquiring a property using leverage and leasing it out for rental income. This income is paid out to shareholders in the form of dividends. The tax code around REITS requires them to pay out at least 90% of their taxable income, which is why the dividend payment is higher than average. Shareholders must claim the dividends as capital gains on their tax returns.

REITs are still beneficial to the operators who utilize all of the tax codes to yield the highest profit. Operators of REITs can defer certain gains and make an income before profits are calculated for dividends.

The downfall of REITs is that the return will be lower than investing in real estate yourself because the organization has to make a profit in order to keep the trust alive. It’s like outsourcing a real estate investment. This doesn’t make it a bad deal, but should be considered when creating a long term financial goal.

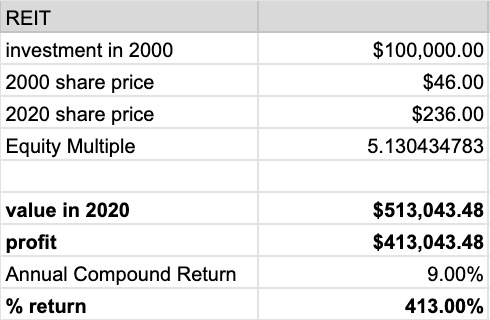

Interestingly, REITs as a whole have outperformed indexes such as the S&P over the last 20 years. One popular REIT is AMT, American Tower Corporation. If you would have invested $100,000 in AMT in 2000 when the share price was $46, today you would have $513,043 with a profit of $413,043.

Residential Real Estate

Both residential and commercial real estate have the obvious benefit of being a physical asset. If the economy tanks, the value of the property will not likely fall as fast as the stock market. This makes real estate a good option for those who can’t stomach volatility.

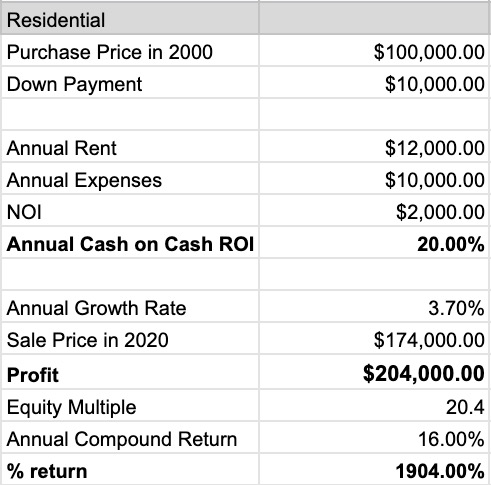

Residential real estate requires less capital than commercial real estate and is a great place to get started. Typically, 10% of the purchase price is required as a down payment and the rest can be borrowed.

If you are purchasing a rental property for $100,000 that requires $10,000 as a down payment, the remaining $90,000 can be borrowed as a mortgage. There will also be closing costs, so keep in mind that these are round numbers for hypothetical examples.

Assume the annual rent is $12,000 and the annual expenses, including the mortgage payment and capital expenditures, are $10,000. This leaves a net operating income of $2,000, which equates to a cash on cash ROI of 20%. The principal amount owed is also getting paid down, so the real rate of return will be higher.

Historically, real estate has increased in value at a rate of 3.7%. This doesn’t like much, but remember that the purchase was made using leverage. Since only 10% of the purchase price was required upfront, this leads to a 37% return on the capital outlay.

Assume a $100,000 house was purchased in 2000 and grew in value at an annual rate of 3.7% while generating a net operating income of $2,000 a year. The value of the house would be $174,000 and the total profit from rent would be $40,000. This means the $10,000 down payment yielded a return of $204,000. That equates to a 16.5% annual compounding return and a total return of 1,904%.

Note: At the time of sale, there may be a small debt balance remaining for the property which is not considered in these examples.

These numbers are staggering, however, there is a huge caveat. This is not to be mistaken with passive income. Residential rentals require time and attention, so this is better categorized mini-business. The amount of money that your time and attention is worth will have to be determined by you. $2,000 a year may not be a great return on investment if it requires several hours a month of your time.

Another drawback to residential real estate is that it does not scale proportionally. Specifically, rent doesn’t increase at the same rate as the purchase price. A house that sells for $100,000 might easily rent for $1,000 a month, but a house that sells for $1 million will probably not rent for $10,000 a month. So, although the rate of return looks great on paper, the actual amount of money earned is bottlenecked by the amount of deals completed.

We think residential real estate is a great first step as an investor. Whether your 18 or 58, buying a property to rent or flip will show you what to look for when investing money with others as well as give you an appreciation for the work that goes into running a real estate business. Step two is usually getting involved in a small multi-family project such as a duplex, triplex, or quadplex. Lastly, most real estate investors end up gravitating toward commercial real estate as the final step.

Commercial Real Estate

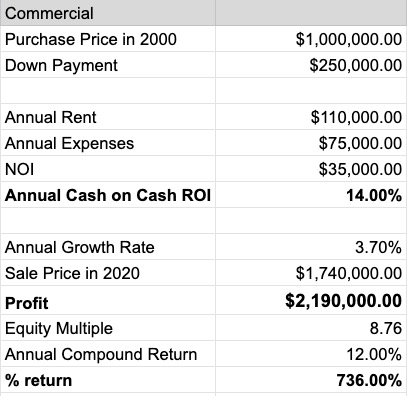

Commercial real estate is different than residential because the value of the asset is driven by the cashflow where as in residential real estate the value is driven by the location. Commercial real estate also requires a higher down payment because most banks will only lend 70-80% of the value of the building. This means the cash on cash ROI will be lower. However, commercial real estate has near infinite scalability.

Let us say a commercial building is purchased in 2000 for $1,000,000 that requires a $250,000 down payment, has an annual rent collection of $110,000, and $75,000 of annual expenses. The net operating income, NOI, is $35,000. This equates to a cash on cash ROI of 14%. Assuming the same annual growth rate of 3.7%, the building would be worth $1,740,000 in 2020. Adding together the net income plus the appreciation of the asset creates $2,190,000 in profit for the investor. This equates to a 12% annual compound return and a total return of 736%.

The ROI of commercial real estate is lower in this example because the down payment is higher, but this ROI holds true as the value of the building increases. So, on a $10 million commercial asset, the investor can still expect similar returns. In order to get the same return on $10 million in residential real estate, the investor would have to purchase 100 houses.

Another factor in deciding which route to go is the quality of the tenants and the lengths of the leases. In residential, 12-24 months is considered a long lease and the landlord is responsible for all maintenance and repairs. In commercial, a good broker will have tenants sign leases for five to ten year terms. Additionally, commercial tenants are usually responsible for maintenance up to a certain amount. This means that commercial real estate is much closer to passive income than residential.

Although both options are have benefits, commercial real estate investments require less time and attention while providing scalability which is what makes it the final destination for so many investors.

Stocks

There are multiple ways to invest your money in the stock market, including:

- Shares of individual companies

- Index funds

- Leveraged index funds

- Options

The simplest way to invest is to buy shares of a public company. If the company grows, the shares become more valuable and your investment compounds, but if the company underperforms then the value decreases. The ultimate risk is that if the company goes under, the value of the shares goes to zero.

A safer way to invest is to buy an index fund like the S&P 500 which represents 500 of the most successful companies in the world. Because there are so many companies represented, this single fund provides diversification and lowers the risk of bad performance.

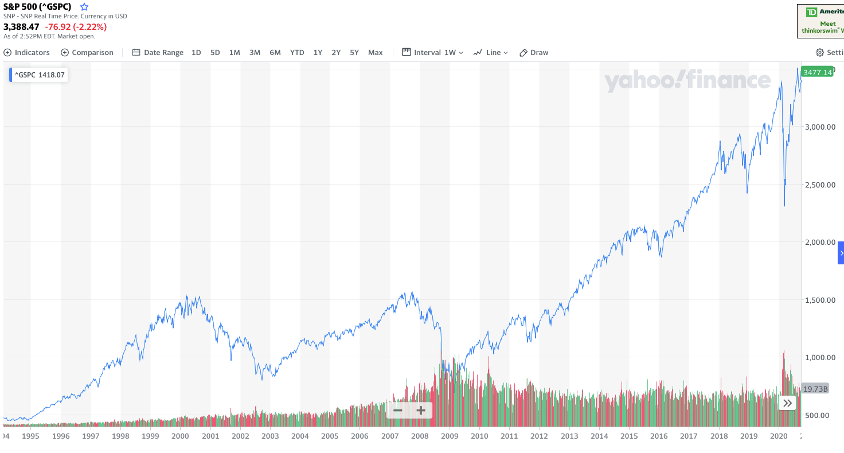

In 1996, the S&P 500 was trading at $700. In October 2020, shortly after the corona virus sell off, the S&P was trading at $3,465. This equates to a 7% annual rate of return. Although not great, the fact that the market continues to make all time highs after a pandemic is a bullish indicator of things to come.

Let’s consider the financial crisis of 2008. If you had invested on the worst day in 2007 when the S&P was trading at $1,556, you would have doubled your money by 2020. If you had invested on the best day in 2009 when the S&P was trading at $667, you would have quintupled your investment with 419% return by 2020. That is the power of compounding interest.

Over a short time frame, stocks can be risky because of the volatility. If you had invested during the dot com bubble of 2000, it would have taken 13 years to break even. However, if you have a time frame of 20 years or more you will drastically increase your odds of success. In fact, there has never been a time in history where the market did not significantly increase over a 20 year horizon.

Generally, those who try to time market miss out on significant gains. We recommend picking a set amount and investing it every month in an index fund such as the S&P regardless of what the market is doing. There will always be bad news on TV and talking heads on social media claiming the next bear market is right around the corner, but American innovation has historically moved society forward and the stock market up. Over time, the up days will out weigh the down days, and your wealth will start to compound significantly.

To get an understanding of the power of compounding interest, check out this helpful calculator. https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

One final benefit to investing in stocks is the liquidity factor. If you need to pull your money out for any reason, you can instantly liquidate as much of your portfolio as needed. Other investments may require your capital to be tied up for years.

The goal if this article is not to push one investment over another, but rather to help to simplify a complex subject by providing data and perspective. Any of the investments listed above are better than cash.

If you need help finding a location or you’re ready to invest in commercial real estate, email us at podcast@leadersre.com or go to www.leadersre.com and fill out our form.

*We are not financial advisors and do not endorse any particular investment. All references above are hypothetical and we are not responsible for any gains or losses incurred by following these recommendations.*